How Much Does It Cost An Apps/loyalty-customer-referrals/ For My E-commerce?

Buying a bra that fits according to expert standards has, for years, entailed a visit to a department store or a lingerie shop, where employees double as "fit experts" who determine shoppers' band and cup sizes in the confines of a dressing room. But that may be changing, as online retailers debut new methods for lingerie shopping that can be done easily–and, they hope, effectively–from a computer screen.

"People hate the fitting room experience," says Aarthi Ramamurthy, who launched online bra retailer True&Co in May with cofounder Michelle Lam.

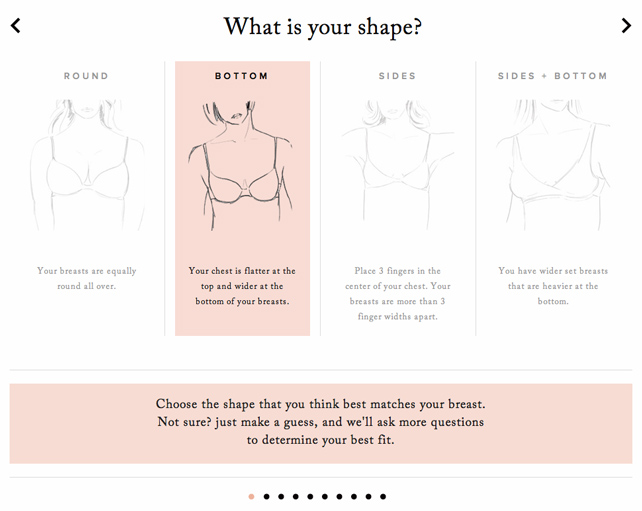

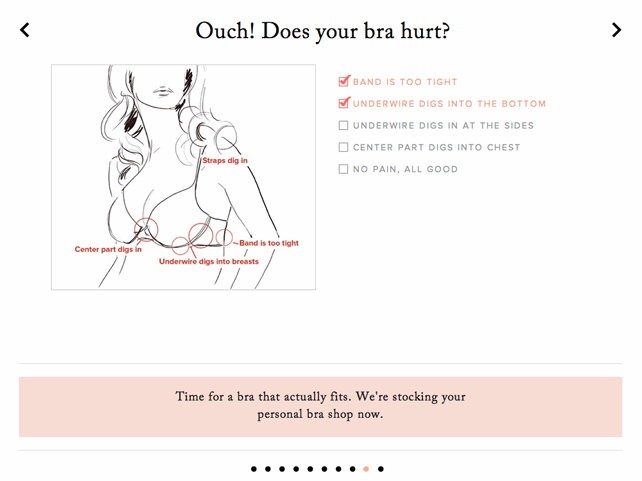

The San Francisco-based startup relies on a questionnaire and an algorithm designed to determine bra size as effectively as a human expert. Bras from brands such as Calvin Klein and Natori are $45 and sold using a model similar to that of game-changing eyewear retailer Warby Parker: customers receive a box of five bras and have a week to try them on, keep what they want and send back what they don't. Shipping and returns are free. True&Co uses information about what you keep and what you send back to help customers make better decisions about their next purchases.

Also making a play for a piece of the $12 billion intimate apparel market are New York's Adore Me and intiMint, the latest brand from Santa Monica's BeachMint, whose other celebrity-endorsed subscription sites include JewelMint and StyleMint. Both AdoreMe, launched last November, and intiMint, which debuted in June with Brooke Burke-Charvet as its celebrity muse, offer monthly memberships and suggest products shoppers are likely to be interested in using online questionnaires. And online retailer HerRoom, around since 1998, padded its approach with the May debut of its online Universal Cup Sizing tool to help shoppers find bras that fit, despite inconsistent brand sizing standards that often lead to two bras of the same size failing to fit the same woman.

How to explain all the sudden exposure? For retailers and entrepreneurs, intimate apparel offers attractive elements that standard apparel does not. For one, lingerie can be lucrative. Profit margins for retail apparel stores average 3.4%, but lingerie stores routinely see double that, according to recent research from IBISWorld.

"This is because the material cost of production is relatively minimal," says IBISWorld senior analyst Caitlin Moldvay.

Then there's the fact that while women (most of them, anyway) wear bras and underwear every day, fit and comfort are often hit-or-miss.

"A bra is a very difficult product to purchase. It's probably one of the most difficult parts of the body to dress," says AdoreMe CEO Morgan Hermand-Waiche.

It's common for women to stick with brands they know.

"Typically consumers tend to develop higher brand loyalty with lingerie lines. You can see that with Victoria's Secret," Moldvay says.

Speaking of the leading brand, newcomers to the space would like to fragment the market dominance Victoria's Secret has long enjoyed.

According to BeachMint cofounder and president Diego Berdakin, "The combination of getting to know our customers better and delivering unparalleled value by bypassing retailers and wholesalers creates a truly disruptive experience in the intimate apparel market, where one brand has dominated for a long time."

Without the overhead costs of stores or catalogs, online lingerie retailers are able to offer shoppers lower prices. IntiMint merchandise starts at $19.99, while AdoreMe offers $39.95 sets that range from bras and panties to swimwear, sleepwear and corsets.

"We can have all our inventory in one central location in the U.S… we are just much more lean," says Hermand-Waiche.

Thus far, the combination of compelling prices, fashion-conscious merchandise and successful personalization tools seems to be striking a cord with shoppers.

Exiting a private beta testing period in late May, True&Co reports that 100,000 people took its online quiz. Inventory was wiped out, though shipping is planned to resume later this month.

AdoreMe has seen sales grow by 50% each month since November. Though the company declined to give numbers, intiMint characterizes its first month as a positive one.

"In our first month, intiMint is already seeing impressive metrics. We're seeing a high average order value and impressive level of customer engagement," reports Berdakin.

Also compelling is the data new e-commerce companies are able to capture about women, as well as its potential value to lingerie brands.

"There's a lot of possibility for us to feed back data to these companies that they've never seen before," Lam says.

How Much Does It Cost An Apps/loyalty-customer-referrals/ For My E-commerce?

Source: https://www.fastcompany.com/1842216/adventures-customer-support-e-commerce-gets-some-new-breast-friends

Posted by: mashburnguideare.blogspot.com

0 Response to "How Much Does It Cost An Apps/loyalty-customer-referrals/ For My E-commerce?"

Post a Comment